Gaurav Sungvani (Guest writer)

Digital Marketer | Writer | Aspiring Entrepreneur | Free Market Liberal

While Silicon Valley is still the epicenter of entrepreneurship and the destination for college grads who need to build a company, the venture capital that fueled the startup economy in the past couple of decades is beginning to flow somewhere else.

New York & London still get a big share of what doesn’t flow to Silicon Valley; and India and China have made substantial gains. Be that as it may, in the emerging markets of Malaysia, Vietnam, Indonesia and Philippines, investors are discovering an ever-increasing number of reasons to invest. Why?

Why are VCs looking at these markets?

Venture capitalists are progressively interested in emerging markets, and in working with local funds based in those markets (even though reverse innovation in venture capital appears to be nonsensical). The purpose behind the enthusiasm is that the industry has suffered from poor returns on investment in recent times; indeed, a few areas report negative total returns. China and India offer alluring liquidity and investment opportunities VCs haven’t seen for some time.

This push into emerging markets has gained momentum since venture capital is encountering issues in its traditional markets. Silicon Valley was once so inward-looking that venture capitalists used to state they would not back a start-up unless they could cycle to its office. In any case, valuations in North America have ascended for both early-stage and later-stage investments, making it considerably harder to make good returns.

A report by the Kauffman Foundation

analyzed its venture-capital portfolio and concluded

that 62 out of 100 funds failed to exceed

the returns offered by the public market.

A report by the Kauffman Foundation analyzed its venture-capital portfolio and concluded that 62 out of 100 funds failed to exceed the returns offered by the public market.

Most venture-capital firms don’t head abroad with the sole aim of searching for copycats, however a lot of their investments end up that way.

Introducing Clone Models to new Markets

After all, backing tested concepts mitigates the risks in new businesses and means organizations are probably going to grow quickly, because the original company has worked out all the bends. Often the originator of the business does not have the expertise to enter new developing markets so fast, so copycats can get there first.

They can likewise gain an edge by tailoring organizations to local habits. Flipkart, an ecommerce website in India founded by two former Amazon employees, had raised funds from Tiger Global, a New York-based hedge fund that has some expertise in this sort of investing, and Accel Partners, a venture-capital firm. Honestly, the idea worked because around then individuals scarcely used credit cards in India and to make it mainstream they needed to present something like cash on delivery.

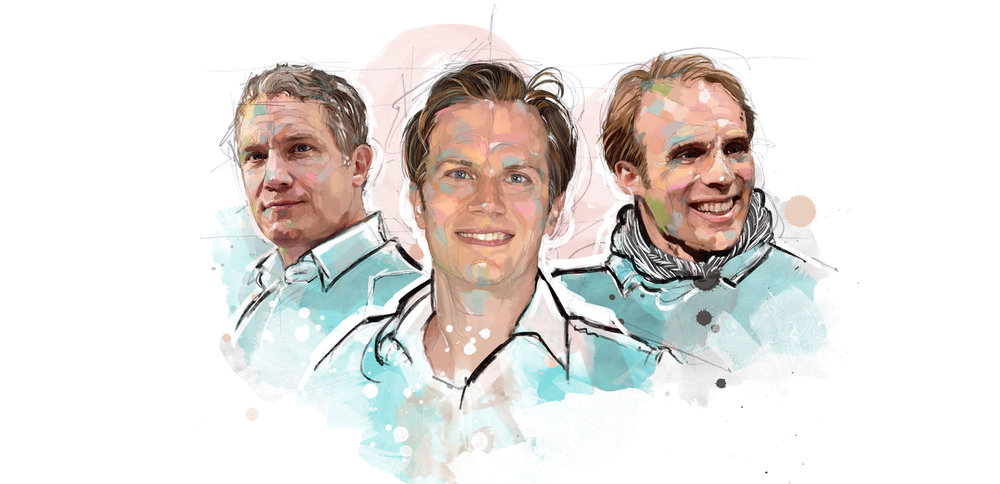

There are diverse approaches to play the copycat game. Rocket Internet, started by the Samwer brothers—Alexander, Marc and Oliver—in Germany, is a cloning factory that copies American and European organizations, hiring entrepreneurs to run them and exporting these new companies to emerging markets as fast as possible so they are the first entrants. More traditional venture capitalists are setting up offices and specifically backing local entrepreneurs. American venture capitalists often like to acquire a local partner to give more reliable mentorship to these entrepreneurs and give exhortation on the best way to navigate the domestic market.