Easypaisa Revolutionizes QR Payments with the Innovative Digital Easypaisa Merchant Initiative

ISLAMABAD ( Web News )

Easypaisa, Pakistan’s leading digital payments platform, has introduced a convenient service for individuals and sole proprietor merchants who have a need to collect digital payments from their customers. Using the existing Easypaisa App, customers can now signup as an Easypaisa merchant instantly and start collecting instant payments from other Easypaisa customers using QR codes. This digital merchant sign-up process is in-line with the State Bank of Pakistan’s regulations, and offers instant fund settlement and a separate dashboard visibility, all through the existing Easypaisa App.

Over the last few years and especially during the COVID-19 pandemic, contactless transactions have seen a rapid rise through wide-scale acceptance amongst the masses. QR payments are one such avenue and Easypaisa has led with innovation in this space. As a digital merchant, not only have registrations been made easier but the account limits have also been enhanced to handle greater volume of payment transactions of up to PKR 500,000 per month.

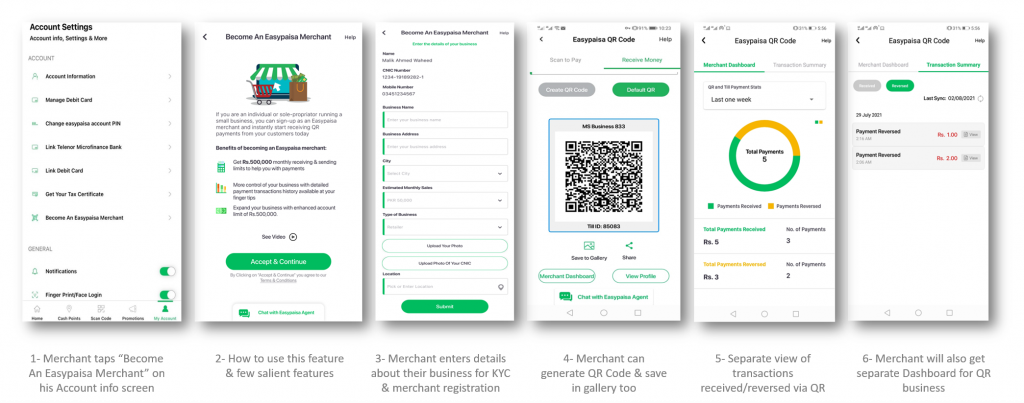

In order to begin the process, a customer can simply open their Easypaisa App and tap on ‘Become an Easypaisa Merchant’ option available on the account information screen. Once the merchant details are entered, the Easypaisa platform will instantly generate a QR code on screen. Merchants also have the option to generate a dynamic QR code. This QR code can be scanned directly by customers, or saved in the phone gallery or printed and placed on the counter. Customers must have an Easypaisa App to scan this QR and all payments will be instantly settled into the merchant account.

Easypaisa continues to be at the forefront of developing best in class technological solutions to create avenues for businesses and customers to transact digitally through a variety of channels. With this new functionality, merchants can now acquire their respective QR codes digitally resulting in a drastic reduction of onboarding time and efforts in order to provide seamless, convenient and secure digital financial services to customers.