Nevertheless, the economic expansion may go along with a current account deficit,

All this augurs well for sustaining the momentum of tax collection achieved during Q1 FY2022,

ISLAMABAD ( Web News )

Keeping in view the performance of various economic indicators, the economic recovery that had accelerated since March 2021 is expected to continue, according to the Monthly Update and Outlook for October 2021, released by the Finance Ministry here Thursday.

According to the report, increased production may boost exports while domestic production might partially substitute for imported products and increased incomes generated by economic growth would raise product demand.

“Increased production also stimulates exports, while supply side induced increase in domestic production may partially substitute for imported products. On the other hand, the need for necessary intermediate inputs in the production process also increases. The increased incomes generated by economic growth also raises the demand for domestic and foreign products,” the report says.

It says that measures were being implemented to curb unnecessary imports which do not contribute to the expansion of domestic production.

Nevertheless, the economic expansion may go along with a current account deficit, it says adding that it was normally recognized that emerging and developing countries run current account deficits, financed by financial inflows from developed nations.

It is strongly realized that as long as the deficits are manageable, their contribution remains productive for achieving the higher and sustainable growth trajectory, necessary for the convergence of per capita income with developed countries, it added.

According to the report, by the end of first two months of fiscal year 2021-22, the fiscal deficit restricted to almost same level as it was in the comparable period of last year.

It says, the government was following a careful expenditure management strategy to ensure that critical areas were not ignored and that sufficient resources are available for growth-oriented and social security-related programs.

These measures would pave the way for better fiscal prospects and sustained economic recovery.

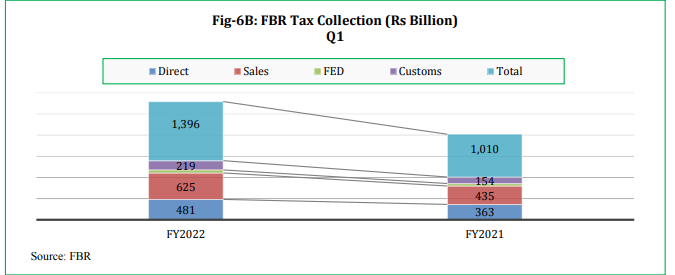

On revenue side, the report added, the Federal Board of Revenue (FBR) was focused on sustaining successful streak of surpassing tax collection target during first quarter of FY2022 and had already taken a number of initiatives in this regard.

The board is implementing digitalization and automation of various processes involved in revenue collection; the launching of Point of Sale (POS) and Track & Trace system were examples of such initiatives.

Furthermore, FBR has taken number of measures to promote economic activities through maximum taxpayer facilitation.

All this augurs well for sustaining the momentum of tax collection achieved during Q1 FY2022, it says adding FBR was on course for achieving the revenue target set for FY2022, the report adds.

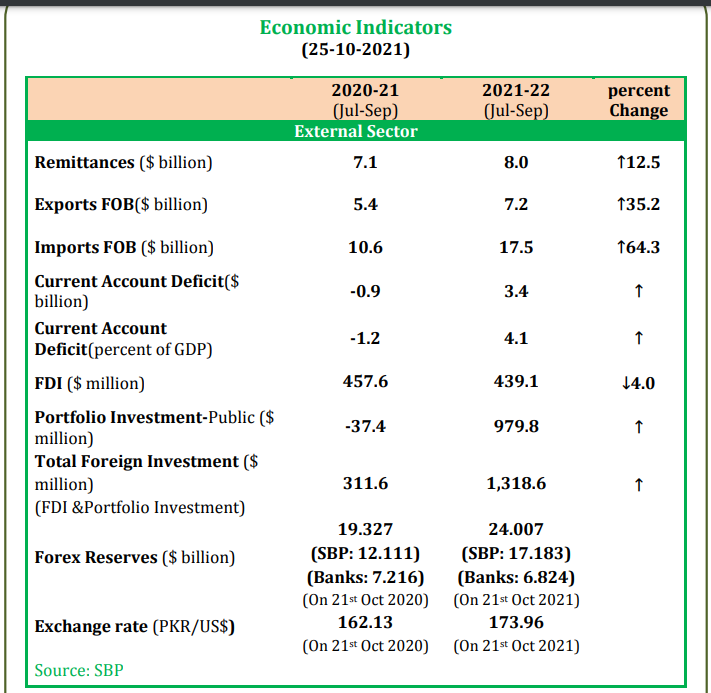

On external side, it says, imports of goods and services in September were marginally lower than their levels observed in August. The persistent rise in international oil prices, exchange rate pressure and the rise in domestic economic activities were contributing in rising import demand.

Given these recent dynamics, it can be expected that in the following months, imports may remain at current high levels. Therefore, the recent government steps in terms of monetary policy and the measures taken to discourage unnecessary imports would be helpful in containing the strong expansion recorded in recent months.

As expected, exports of goods and services crossed the $ 3 billion mark, helped by the ongoing strong recovery in Pakistan’s main export markets, the momentum in domestic economic dynamism and specific government policies to stimulate exports. These dynamics are expected to keep exports above the $ 3 billion mark in the months ahead.

As a result of these events, the trade deficit of goods and services retreated from the level observed in August and is expected to first stabilize and then decline in the months ahead.

The report says, if remittances stay roughly at current levels in the coming months, then taking into account the other income inflows having relatively minor share, the current account deficit would be driven by the trade deficit which would be stabilized and improved thereafter, but these developments will be monitored closely.

On inflation side, it says, the inflation rate was mainly driven by monetary and supply side factors i.e., domestic and international commodity prices, USD exchange rate, seasonal factors and economic agents’ expectations concerning the future developments of these indicators.

government’s structural polices to improve the functioning of market structure particularly the food markets play an important role.

Since May 2021, YoY inflation has observed downward trend till September 2021. However, the recent surge in international oil prices, exchange rate depreciation and adjustments in administered prices.

The effect of these impulses may intensify the magnitude of prices and transportation cost. Traditionally the month of October shows positive seasonality.

On the other hand, the government is committed to ensure the smooth supply of essential commodities in domestic food markets to protect livelihood of the people. If there would be no additional impulses in October, then YoY inflation may decelerate.

It says, the preliminary production estimates of major Kharif Crops 2021 were encouraging while the inputs availability would remain satisfactory as more certified seeds for wheat and other crops would be ensured for upcoming Rabi 2021-22 season, thus it is expected that in the absence of any adverse climate shock, agriculture sector would surpass its target of 3.5 percent.

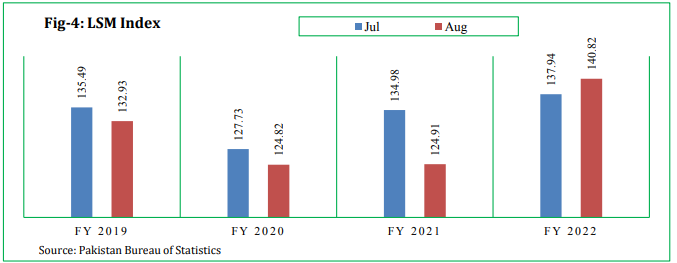

According to the report, the Large Scale Manufacturing (LSM) index for August came in close to expectations and in September, it is expected that LSM would roughly stabilize around the level observed in August.

The Monthly Economic Indicator (MEI) is expected to remain strong, reflecting low base effects and the continuation of the dynamism in domestic value-added creation, supported by government’s pro-growth and inflation-containing policies.

Also, the government policies to bringing COVID-19 infections under control accompanied with the further relaxation of restrictions may contribute significantly, the report adds.