President Alvi directs SLCIP to improve its policy on medical tests before the issuance of Life Insurance policies to prospecting policyholders

ISLAMABAD ( Web News )

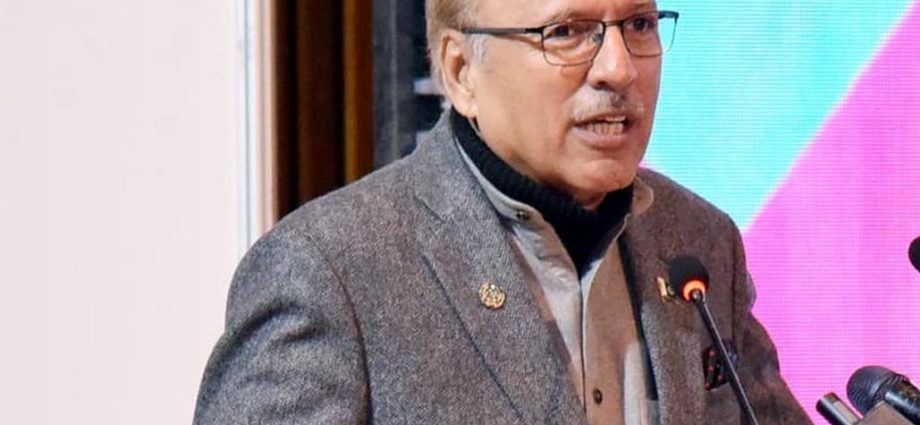

President Dr. Arif Alvi has directed the State Life Insurance Corporation of Pakistan (SLCIP) to improve its policy on medical tests before the issuance of Life Insurance policies to prospecting policyholders. He asked SLICP to constitute a panel of doctors which should suggest as to what were the most prevalent and common diseases in Pakistan and what tests should be conducted before the issuance of policy.

President Dr. Arif Alvi gave these orders in view of the fact that a number of representations were being filed with the President by the insurance companies as well as citizens in cases where insurance companies were denying the payment of death insurance claims to family members of the insured policyholders on the ground that they had willfully hidden ailments at the time of obtaining the policy. The payments were being refused despite the fact that the policies had been issued after the policyholders had been declared medically fit by the authorized medical officers as well as the field officers of the insurance companies.

President Dr. Arif Alvi issued these directions while rejecting two separate representations filed by SLICP against the decisions of the Wafaqi Mohtasib (WM) directing it to pay Rs 3.68 million to the family members of two policyholders to whom SLICP had denied payment on account of them hiding pre-insurance ailments.

As per details, Muhammad Yousaf and Ms Abida Bibi had obtained life insurance policies from SLICP for the sums assured of Rs 3,485,000 and Rs 200,000 respectively. After their deaths, their family members approached SLICP for the payment of insurance claims but SLICP refused to pay them the respective amounts on the ground that they were patients of diseases, such as Hepatitis C, chronic kidney disease, heart condition and hypertension and they did not disclose the existence of these ailments before SLICP. Feeling aggrieved, the family members separately filed complaints with the Wafaqi Mohtasib, which passed the orders in their favour. SLICP, then filed representations with the President, which were rejected.

The President in his decision observed that the two policyholders were declared medically fit by the concerned medical officers as well as the field officers of SLICP who stated that they knew the policyholders for a number of years. He noted that pre-insurance ailments could easily be diagnosed and detected by the medical officers as the services of these officers were arranged to examine policyholders prior to the issuance of policies. He maintained that SLICP could not take the plea of pre-insurance ailments to deny payments as under Contracts Acts 1872, where the consent was caused by misrepresentation or fraudulent means, the contract was not voidable if the party whose consent was so caused had the means of discovering the truth with ordinary diligence. He said that SLICP had all the means of discovering the alleged ailments by exercising due diligence through its authorized medical officers.

President Dr. Arif Alvi held that SLICP had committed maladministration by repudiating the insurance claims on such flimsy grounds, adding that it could not produce any evidence establishing the existence of pre-insurance ailments. He, therefore, directed SLICP to pay Rs 3.68 million to the family members with the direction to improve its policy regarding medical tests. He said that SLICP could devise a risk assessment method about different diseases, decide and modify premiums for different diseases such as diabetes, hypertension etc and avoid litigation in future.