As part of the agreement, Zhao will personally pay $50 million, marking one of the largest corporate penalties in U.S. history, a significant setback for the cryptocurrency industry already grappling with investigations.

Notably, FTX founder Sam Bankman-Fried recently faced fraud charges.

Despite the substantial fine, legal experts view the outcome as favorable for Zhao, allowing him to preserve his considerable wealth and retain ownership of Binance, the exchange he established in 2017.

The charges against Binance include violating U.S. anti-money laundering and sanctions laws, failure to report over 100,000 suspicious transactions involving entities labeled as terrorist groups, and neglecting to report transactions with websites involved in child sexual abuse materials.

Additionally, Binance was identified as a major recipient of ransomware proceeds.

U.S. Attorney General Merrick Garland remarked that Binance facilitated criminal activities by providing an easy platform for the movement of stolen funds and illicit proceeds. The settlement, negotiated by the Justice Department with the Commodity Futures Trading Commission (CFTC) and the Treasury Department, includes a $1.81 billion payment within 15 months and a further $2.51 billion forfeiture.

The Justice Department is seeking an 18-month prison sentence for Zhao, the maximum suggested under federal guidelines. Binance’s former chief compliance officer, Samuel Lim, faces charges from the CFTC.

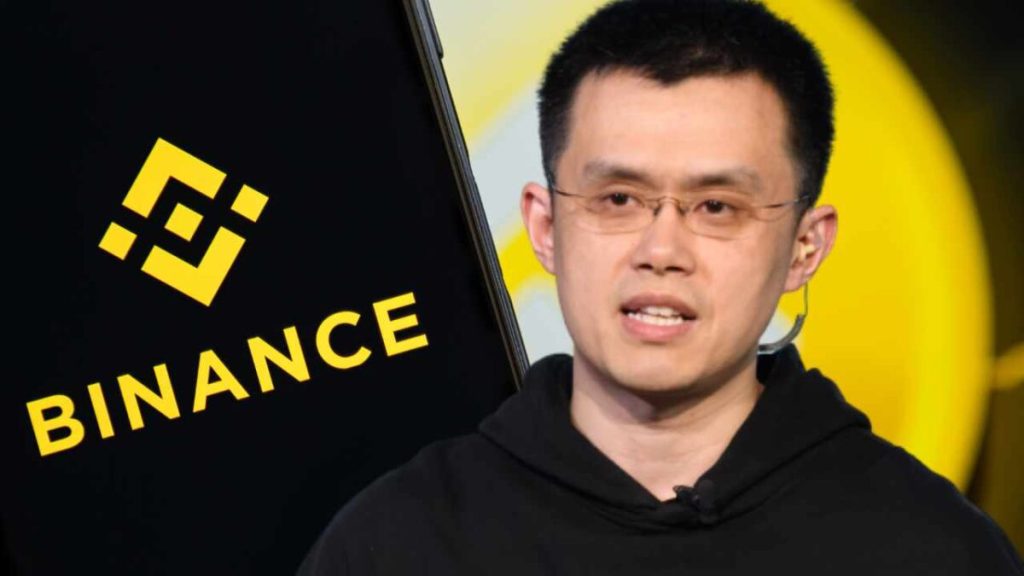

Zhao, a Chinese-born billionaire who moved to Canada at age 12, pleaded guilty in a Seattle court and stepped down as Binance CEO, expressing responsibility for mistakes made. Richard Teng, a longtime Binance executive, is set to take over the leadership.

While the settlement poses challenges for Binance’s future, retaining his stake allows Zhao to potentially exert influence on the company. The fine, though substantial, appears manageable for Binance, signaling a chance for the exchange to move forward after acknowledging historical compliance violations.

In response to the resolution, Binance released a statement acknowledging the company’s responsibility for past criminal compliance violations, emphasizing the opportunity to turn the page. Teng, in a separate statement, underscored his focus on assuring users of the company’s financial strength and security.

Despite the gravity of the violations, legal analysts note that Zhao’s retention of his Binance stake and substantial wealth positions him favorably in the aftermath of the settlement. Prosecutors likely considered these factors when negotiating the terms to encourage Zhao’s cooperation and secure a significant corporate fine.