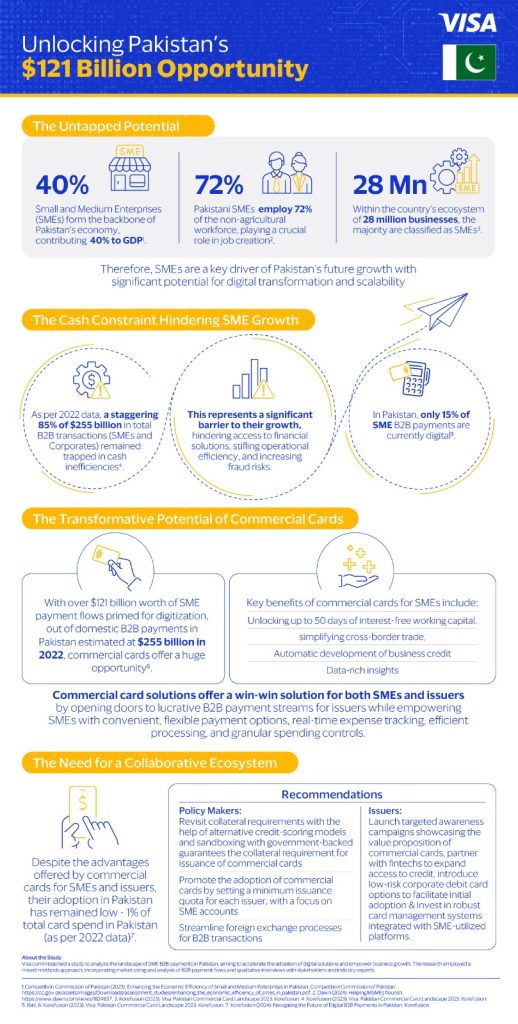

Unlocking the $121 billion opportunity: Visa highlights commercial cards’ role in Pakistan’s SME growth and digitization

85% of the estimated $255 billion in B2B transactions were cash-based in Pakistan

KARACHI ( WEB NEWS )

Visa (NYSE: V), a world leader in digital payments, today released a whitepaper highlighting the advantages of digitizing SME payments — with over $121 billion[1] worth of SME B2B activities primed for digital transformation.

Umar S. Khan, Country Manager for Pakistan & Afghanistan, Visa, commented: “As a cornerstone of Pakistan’s economy, SMEs contribute 40%[2] to the national GDP and are vital to job creation. However, despite their growth potential, many SMEs remain constrained by their reliance on cash-based transactions, which hampers efficiency and scalability.

At Visa, we recognize the transformative power of digital payments in addressing these challenges. Our latest whitepaper highlights how commercial cards can revolutionize B2B payments for SMEs, offering streamlined processes, and access to critical financial solutions.

To unlock this opportunity, we must work together to encourage widespread adoption. By partnering with government entities and banks, raising awareness, and collaborating with fintechs, we can improve access to the infrastructure SMEs need to thrive. These efforts align with Visa’s commitment to supporting Pakistan’s digital and economic agenda, fostering an inclusive ecosystem that empowers SMEs to grow, innovate, and compete locally and globally.”

In the State Bank of Pakistan’s Payment Systems Quarterly Review for the first quarter of 2025, 55.6 million payment cards were in circulation, with debit cards comprising 88% of the total[3].

In Pakistan’s current payment market, SMEs struggle with payment and transaction challenges rooted in legacy solutions. Often, SMEs are unaware of the availability and many benefits of commercial cards. Cumbersome application processes and compliance procedures further prohibit SMEs from transitioning to digital transactions. On the other hand, banks and financial institutions view SMEs as high-risk clients due to their lack of collateral and credit histories.

Key highlights from the whitepaper:

Analyzing the payment landscape

- A staggering 85%[4] of the estimated $255 billion in Pakistan’s B2B payment flows in 2022 were cash-based, representing a significant amount of inefficiencies

- In Pakistan, 15%[5] of SME B2B payments are currently digital, indicating a shift to the adoption of digital channels.

- While the number of card transactions for consumers and small businesses is high, much of this activity is limited to cash withdrawals

- Agriculture, retail, and manufacturing sectors dominate SME payables in Pakistan. The IT industry processes a significant volume of B2B payments, with the majority being international transactions

The Potential of Commercial Cards

- Of the estimated $255 billion in Pakistan’s B2B payment flows in 2022, over $121 billion[6] of this opportunity originates from SMEs. These are primed for digitization, presenting a significant opportunity for commercial card solutions for the SME sector

- The largest 8% of SMEs account for a substantial 60% of total SME payables[7], whereas small-value transactions contribute approximately USD 6 billion, making commercial cards more relevant, secure, and reliable for segment

- Commercial cards also address many bottlenecks to SME growth including interest-free working capital, simplified cross-border trade, building business credit, and providing data-rich insights

- Commercial card solutions can also empower SMEs with convenient payment options, real-time expense tracking, efficient processing, and granular spending controls

The Need for a Collaborative Ecosystem

- There are several measures policy makers can take to enable the proliferation of commercial cards:

o Revisiting the collateral requirement for issuance of commercial cards, which can be supported by development and enrichment of alternative credit-scoring models and sandboxing with government backed credit guarantees.

o Promote the adoption of commercial cards by setting a minimum issuance quota for each issuer, with a focus on SME accounts

o Streamline foreign exchange processes for B2B transactions through various methods such as: establishing tiered limits for international transactions through commercial cards based on business size, allowing banks to automatically process smaller value transactions, and introduce automated mechanisms for extracting and consolidating card based transaction data, thereby decreasing paperwork.

- Issuers can facilitate the adoption of digital financial tools and long-term behavior changes:

o Invest in robust card management systems integrated with SME-utilized platforms

o Launch targeted awareness campaigns showcasing the value proposition of commercial cards

o Partner with fintechs to expand access to credit

o Introduce low-risk corporate debit card options to facilitate initial adoption.

Visa’s whitepaper recommends a strong commercial cards product suite that offers a range of value-added services to drive convenience, efficiency, flexibility, and spending control to SMEs. Additionally, issuers stand to gain by realizing new B2B payment streams by shifting spending from consumer to commercial cards. Furthermore, issuers can gather valuable customer data based on card usage for improved segmentation and product optimization.

About the study:

Visa commissioned a whitepaper to analyze the landscape of SME B2B payments in Pakistan, aiming to accelerate the adoption of digital solutions and empower business growth. The research employed a mixed-methods approach, incorporating market sizing and analysis of B2B payment flows and qualitative interviews with stakeholders and industry experts.

Explore key insights from the whitepaper in the accompanying infographic available here